Please forward this blog on to all your email contacts.

The Great British rake-off… what really happens to the billions YOU donate to charity: Fat cat pay, appalling waste and hidden agendas? The Charity Industry needs a massive rassessment.

Charity is surely a voluntary activity? If those running it receives money for themselves it is not a Charity – it is an industry?

The little village of Knockholt in Kent runs a carnival every other year. The villagers all give their time free, nobody is paid. That is a Charity.

M\ny Chrities have now been infiltrated by hard left activists and are overty political

For over 70 years UK has sent £billions to Africa in charitable aid and it is in as dreadful a state now as it was 70 years ago. What has been achieved with all that money, where has it gone?

Your donations help to get them expensive cars and fine wines as well as lucrative pensions.

There are many charities that duplicate what other charities do – you only need one per problem.

It should also be remembered that if a charity solves the problem it has been set to deal with then all those with lucrative jobs in the charity will lose their jobs.

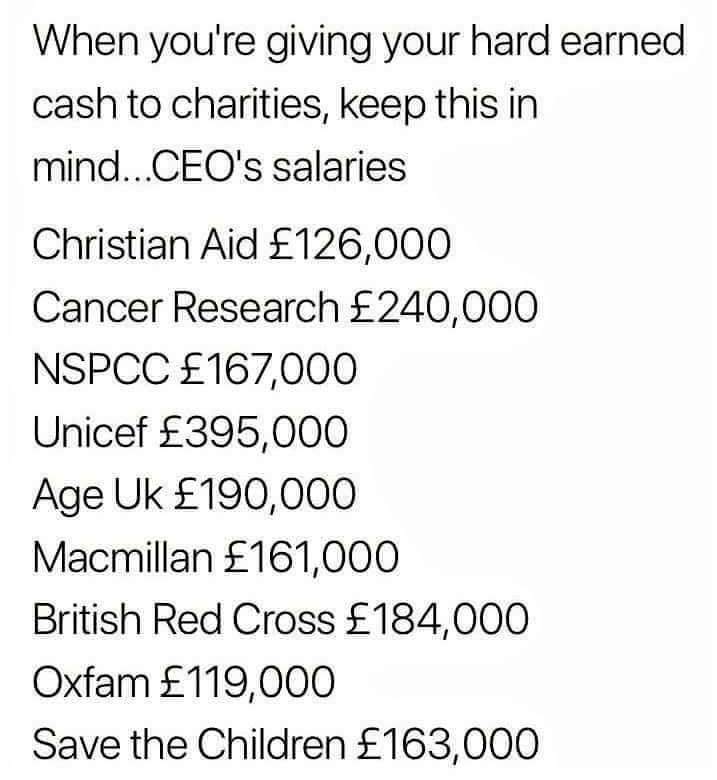

There are two types of Charities. Ones that are run by concerned ‘amateurs’ who personally take out a minimum and those of the Corporate Charity Industry. Defined as Corporates as they operate like Corporates with CEOs on massive salaries, pensions and senior staff on big salaries and very generous expenses.

There are over 90 charities for animals and over 30 for African children – all with CEOs. Surely many of them could combine to reduce overheads that takes funding away from the subjects of the charities?

Comic Relief’s most recently published accounts also show it spent £11.9 million on salaries in 2017, with 30 staff earning more than £60,000 and five pocketing more than £100,000.

The BBC’s Children in Need has donated £10million to Black lives Matter. BLM are a front for Marxism whose aim is the force a revolution by rioting as they are unable to persuade the public to vote them into power. The BBC have done this without informing those who donated the money to help children.

RNLI used money for the lifeboats to buy swimming costumes for overseas Muslims and run a taxi service for illegal migrants. Not what you donated for?

As a rule of Thumb – Never donate to any Charity where the CEO earns more than you. If you do you are probably being ripped off by charlatans.

Two friends of mine when they completed their State Registered nursing went overseas with, I think, Save the Children. In 6 months they saved perhaps 100 destitute children. However, they then came home. They left no more water, land, work or homes and more important no family planning. Now many years later there are perhaps now 3-400 destitute children there. Many of the big Charities are making the problems far worse for the future without family planning. Give free Morning After pills.

When the Labour Party lost the 2010 election they inserted many of their redundant Spads (Special Advisers) into several high-level positions in Charities. They then changed the rules to allow Charities to be political. Hence those Charities are now little more than agents of the Labour Party.

• More than 195,289 charities in UK.

• Many have become ‘hungry monsters’ using money to feed their own ambitions

• David Craig’s new book exposes the truth about Britain’s charity industry

• A recent inquiry found there are too many charities to keep track of their activities

By David Craig For The Mail On Sunday

The figures are astonishing. There are more than 195,289 registered charities in the UK that raise and spend close to £80 billion a year. Together, they employ more than a million staff – more than our car, aerospace and chemical sectors – and make 13 billion ‘asks’ for money every year, the equivalent of 200 for each of us in the UK.

But many charities have become an industry, needing ever more of our money to feed their own ambitions. And while registered charities claim that almost 90p in every pound donated is spent on ‘charitable activities’ (defined by whom?), many spend at least half their income on management, strategy development, campaigning, advertising and fundraising – not what most of us would consider ‘good causes’.

The reality of ‘charity’ for the 3rd world, with its unrestricted population growth, is that Aid without active family planning often makes the situation 20 years later worse. Trade not Aid is massively more effective. Not within the remit of the ‘Corporate’ Charities.

see 2014 – 062 Sir Ian Botham’s exposée of RSPB

see 2013 – 040 Comic Relief and most other Charities need thoroughly re-assessing.

The book, The Great Charity Scandal, is not an attack on charity, but an attack on charities that put their own interests first.

It exposes the truth about Britain’s charity industry, shows how our money is really spent and what needs to be done so that much more of the money we give to charity is used in the way we expect. It’s time to cut them down to size and refocus them on those they should be helping.

And here’s why… In England and Wales there are 1,939 active charities focused on children; 581 charities trying to find a cure for cancer; 354 charities for birds; 255 charities for animals, 81 charities for people with alcohol problems and 69 charities fighting leukaemia. Several for criminals ( But none for their victims)

All have their own executives, administrators, fundraisers, communications experts and offices, but few will admit they are doing exactly the same thing as other charities. Take the case of Ethiopia. Two decades ago there were 70 international charities operating there, today the figure is close to 5,000.

A 2013 parliamentary inquiry into the charity sector found there were so many charities that the Charity Commission for England and Wales was struggling to ensure that most registered charities were genuine, rather than tax avoidance schemes or political campaigning groups.

Common Purpose is a secretive, crypto Marxist training organisation the made itself a charity to avoid the Freedom Of Information Act and it is now impossible to find out who are their alumni.

The inquiry said the Commission, which receives more than 900 calls, letters and emails every day, didn’t have the staff to check whether our donations were actually going to real charitable purposes at all.

The number of active registered charities in England and Wales has remained relatively constant over the past 15 years, but there has been a massive rise in the number of charities raising £10 million a year or more – from 307 in 1999 to 1,005 today.

One possible explanation might be that we all got richer in the boom years and donated more to charity, keeping up our donations after the economic crash. However, there is also an alternative interpretation.

Writing in the Economist in 1955, Cyril Northcote Parkinson gave us what came to be known as Parkinson’s Law: ‘Work expands so as to fill the time available for its completion.’ Parkinson recognised how bureaucracies find increasing quantities of real or fictitious work which leads to the apparent necessity for them to keep growing and pay themselves more because of the increasing amount of work they enthusiastically create for themselves.

The result is that some of our major charities have grown to become remarkably similar bodies. The £368 million-a-year Oxfam, £95 million Christian Aid, £59 million ActionAid, £49 million Cafod and £39 million Care International UK all state their aim is to reduce and end poverty in the Third World. So do War on Want, World Vision, Concern Worldwide and Comic Relief.

You could donate to the £16.3 million- a-year Breakthrough Breast Cancer, the £13.4 million Breast Cancer Care or the £10.6 million Breast Cancer Campaign… and the list goes on. This duplication is hugely expensive.

For example, all charities with an income over £25,000 have to file independently-audited accounts with the Charity Commission at a cumulative cost of £252 million in accountancy fees alone. Some people are beginning to understand this.

The Prostate Cancer Research Foundation, Prostate Action and Prostate Cancer UK laudably decided to merge, with the result that money spent on charitable causes and scientific grants doubled from £8.2 million to £16.5 million, largely due to significant savings in management costs.

The Charity Commission for England and Wales claims that £53 billion of the £63 billion raised is spent on what it calls ‘charitable activities’, an impressive £8.41 of every £10 raised. But its definition of ‘charitable activities’ is loose.

The RSPB hit the headlines after Sir Ian Botham said it was more interested in politics than wildlife. Is that true? Like many charities, the RSPB generates income from commercial activities – £21 million of its total £122 million income in the latest accounts.

But the costs of its commercial activities are £18.4 million, so only £2.6 million of the £21 million raised by selling things goes into the kitty for charitable purposes and administration. Of the £122 million total, the RSPB spent £115 million and retained £7 million for future use.

The £115 million can be split into £32.5 million generating its income and £82.6 million on what it classed as ‘charitable spending’ – roughly 72 per cent. But what does it class as ‘charitable expenditure’?

Some £4 million went on managing its membership, which raised £32 million. Most would regard this as an administration cost, rather than genuine charitable expenditure. Another £14.2 million was used for ‘Education and Communication’ and £34.7 million on ‘Research, Policy and Advisory’ – nearly £50 million on what could loosely be described on campaigns.

The final £29.6 million – just £2.57 of every £10 spent – was actually used for the proper front-line work that many donors might normally associate with the RSPB. Oxfam is another charity stalwart, which claims on its website that it spends £8.40 of every £10 raised ‘saving lives’.

But it’s entirely possible, even probable, that only about half the money raised is actually used for ‘saving lives’. If every working adult and pensioner in Britain contributed £10 per month to charity, the money raised probably wouldn’t be enough to pay the salaries of the executives of our registered charities.

Charity bosses are quick to defend themselves against accusations of ‘fat-cattery’, but the latest research suggests charity executives’ salaries have caught up with those in the public if not the private sector.

The 5,046-employee Oxfam appears to be one of the more frugal of the largest poverty charities. Between the start of the recession in 2008 and the end of 2013, the chief executive’s pay rose by about seven per cent to £108,575, well below inflation.

At Save the Children (£284 million-a- year, 4,025 employees) the highest- paid person’s remuneration rose from £128,310 in 2008 to £168,653 in 2012, an increase of 31 per cent. The highest-paid executive at the Red Cross Society (UK) (£228 million- a-year, 3,200 employees), earns between £200,000 and £210,000, an increase of about 18 per cent.

At Christian Aid (854 employees), the highest-paid employee’s salary rose by 40 per cent from 2008 to £126,206 in 2013 (though the 2013 salary was for a different person). While there isn’t compelling evidence of excessive pay, the cumulative total is huge.

The six biggest anti-poverty charities have 142 staff being paid £60,000 a year or more and 17 with salaries of more than £100,000. In all, about 16,000 charity staff are paid more than £60,000 a year and perhaps 3,000 are getting more than £100,000.

The rewards at smaller charities can, though, appear surprisingly generous. In its heyday, The Princess Diana Memorial Trust (now defunct) had an executive earning between £110,000 and £120,000 for distributing about £6.3 million a year with 15 staff.

The chief executive of the Serpentine Trust that manages two small art galleries in Central London paid its chief executive more than the boss of Oxfam received. This year has seen several major bust-ups between Government and the charity sector.

Oxfam angered the Coalition with its report on poverty in Britain, as did the RSPCA when it attacked plans for a badger cull. Many other charities have also been tempted away from their main focus, into campaigning.

Charities such as Forum for the Future, Friends of the Earth and Green Alliance have been very successful in influencing government policy. Their greatest success was probably in 2008 when the Climate Change Act was passed into law, which by the Government’s own estimate will cost £760 per household every year for four decades.

But many of these charities are funded predominantly by the taxpayer, rather than public donations. Indeed, a number of commentators have identified that many do little in the way of good works, but are actually campaigning organisations or ‘fake charities’.

About 27,000 British charities are dependent on the Government for three quarters or more of their funding. Without Government cash, many would collapse. Nevertheless they spend much of their time and money lobbying the Government rather than doing what most people would consider ‘charitable work’.

Action on Smoking and Health (ASH) is probably the most effective organisation in the anti-smoking lobby, and is very clear that it is a campaigning group. In 2013, ASH was given £150,000 from the Department of Health, £447,074 from other charities, £125,000 from one legacy and possibly only about £6,000 from voluntary donations. So, however worthy ASH’s intentions, it’s not obvious that it is a charity whose purposes are widely supported by an enthusiastic public eager to donate. There’s nothing wrong with lobbying. But the issue is whether an organisation that is mainly focused on campaigning deserves to promulgate its opinions under the banner of being a ‘charity’ while using its charitable status to avoid paying tax on its income.

Britain’s charities haven’t always been so politically active. Until 2004, any form of political lobbying by a charity could only be ‘incidental or ancillary to its charitable purpose’ and could not be a charity’s ‘dominant’ activity.

Charities have many ways of raising money but most controversial is ‘Face to Face’ fundraising, often called ‘charity mugging’ or ‘chugging’. Chuggers aren’t permitted to take cash directly from us. Instead they usually try to get us to set up a direct debit giving say £5 or £10 a month.

Most chuggers work for chugging agencies and are typically paid between £7.50 and £9.50 an hour. Charities will usually pay out between £80 and £120 for each person who agrees to set up a direct debit. This means that pretty much all of a direct-debit donor’s first year’s donations, and sometimes almost two years’ donations, will go to the chugging agency and the chugger.

It’s only after this that the charity gets any money. Many charities that ask for millions in donations also receive a surprising amount of our money directly from the Government. We could call these charities the ‘double-dippers’.

Oxfam, for example picked up almost £137 million from taxpayers in Britain and abroad during the last year – 37 per cent of its revenue. Save the Children also got close to £137 million from taxpayers and Christian Aid was given about £39 million – 41 per cent of its funds.

Some charities refer to this money as ‘voluntary income’, though it’s not clear taxpayers would be so generous with donations if they knew how much of their money the charity was already receiving There is ample evidence that the charity industry is spiralling out of control.

To resolve this, the Charity Commission should force similar charities to merge and create different classes of charities. For example, ‘care charities’ could be used for genuine relief. They would have to show that no more than 15 per cent of revenue is spent on administration and fundraising and no more than ten per cent on campaigning.

A minimum of 70 cent would have to be used for genuine relief. ‘Campaigning charities’ could be allowed to spend more on campaigning, while ‘organisations with charitable status’ (OCS) could have the benefits of being a charity without seeking to raise money from the public – they could take the form perhaps of ‘educational charities’ or ‘political charities’.

In addition, when a charity comes asking for money or appears in the media, it should be under an obligation to let us know what kind of charity it is. The Charity Commission has no oversight over how charities spend our money. Each year, under the Gift Aid scheme, HMRC passes around £1 billion to them.

Just one per cent of this money – £10 million a year – would allow the Charity Commission to hire 200 auditors. And in the Third World, a single agency should have prime responsibility for organising all charity work in each country to avoid waste and duplication.

The Great Charity Scandal by David Craig will be published as an ebook by Thistle on November 27 and will be available on amazon.co.uk.

EXCLUSIVE: Aid agencies ‘exploiting Ebola orphans to fund lavish lifestyle in luxury $800-a-night hotels’

•Aid agency workers living in fancy hotels while orphans struggle to eat

•Liberia minister accuse agencies of handing out huge daily allowances

•Thousands of orphans have been abandoned to the care of neighbours

•More money should be directed to orphaned children, minister claims

By Gethin Chamberlain In Monrovia For Mailonline

Published: 15:35, 17 November 2014 | Updated: 22:32, 17 November 2014

Julia Duncan-Cassell, Liberia’s development chief, says neighbours and relatives are struggling to care for thousands of orphans who have come into their care

Julia Duncan-Cassell, Liberia’s development chief, says neighbours and relatives are struggling to care for thousands of orphans who have come into their care

Western aid agencies are using the plight of Africa’s Ebola orphans to fund a lavish lifestyle in $800-a-night hotels and leaving the children to fend for themselves, according to Liberia’s development chief.

Children who were forced to watch their parents die and were then shunned by their community are being ignored while useless facilities are being built, according to Julia Duncan-Cassell, Liberia’s minister in charge of saving the orphans.

She accused the agencies of handing out $235 daily allowances that are higher than her salary – and that the money invested is wasted on expensive hotels and driving around in big cars.

Dear reader – this a request that if you find these Posts of significant interest would you consider making a small donation of £1, $1 or €1 to help with the running costs. Go to https://www.theeuroprobe.org/ and donate at the top right

One response to “2014 – 070 The Great Charity Scandal”